Content

- Tracking Marketing Expenses

- Using the Right Reporting Tools

- Included in project costs

- Expanded Credits and Deductions for Construction and Real Estate Industries

- How to do cost allocation?

- Real Estate Development Software Solutions – FAQs

- Managing Tax Extensions in Your CPA Firm: Best Practices

- Advanced Property Development Books Bundle$47 [Was $297]

Every project varies, but as a general rule of thumb, hard costs make up 70% to 80% of a project’s budget while soft costs make up 20% to 30%. Real estate is an eminent business domain, and like every other business, accounting plays a huge role here. Accounting is often referred to as the “backbone” of an organization as it helps manage and optimize its financial resources. Unfortunately, many real estate professionals fail to incorporate real estate accounting into their businesses, resulting in losses. Real estate accounting facilitates the calculation of key financial indicators by which you can measure any progress in your business.

What depreciation method is used for real estate?

Other types of property, such as nonresidential and residential real property, must use the straight line method. Taxpayers are generally allowed to elect for a more conservative method of depreciation.

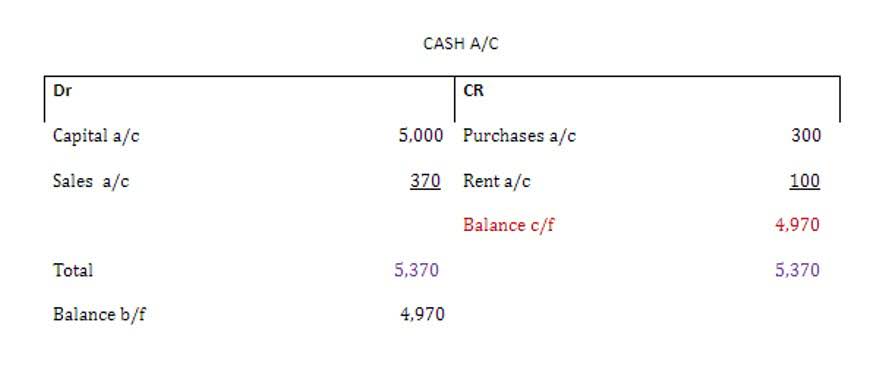

A chart of accounts is a tool that places all the accounts of your real estate business’s general ledger in one place and records transaction details like income and expenses. The next step in real estate accounting is to keep personal and business accounts separate. For this purpose, you can establish a business checking account, which would allow you to tally your income and expenses more efficiently. We’re well versed in both the completed contract method for taxation and the percentage of completion requirement for financial statements. We’ve also helped real estate developers benefit from cost segregation studies, capitalizing costs and taking advantage of depreciation on equipment purchases. While keeping records for tax purposes is important, real estate investors require much more.

Tracking Marketing Expenses

Anton Systems has been working with real estate developers for over 30 years. That’s why CapActix emerges as the one-stop solution for your company’s finance and accounting needs. From bookkeeping to payroll management, our latest accounting solutions emerge as integrated software that will streamline your accounting work, providing you with more time to grow your business. Commercial real estate accounting is conducted on an even larger scale with assistance from software that keeps a good track of all the transactions with pertaining details as well. When banks and investors recognize your accounting firm as high-quality and trusted, your chances of landing a better financing arrangement goes up. Many of our construction and real estate clients have received improved financing terms because of their relationship with Concannon Miller.

It is a customer-centric organization, and their property management software ranks number one on the list for its ease of use and excellent customer support. Good accounting practices in real estate companies sometimes involve the use of accounting software that creates high value in helping improve the income stream of the company. Maintain records for your rental property, including revenue and expenses. Simply put, this guide can get you started on your real estate development and acquisition accounting. But, you may need the guidance of an expert to hold the accounting structures together. So, get in touch with a professional accountant or refer to an online accounting service for fulfilling your real estate accounting needs based on the type of your business.

Using the Right Reporting Tools

We have had several outstanding leaders over the years and have grown to include three office locations. We are grateful for the many clients and friends who have made our success possible. real estate accounting Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high net worth individuals achieve their goals.

It is important to properly record and track these expenses so that they can be optimised in the future. Reporting in real estate accounting is as important as maintaining good books. Invest in good real estate accounting software with capabilities to generate reports automatically, and deliver insights on any device that the users log in from. Real estate accounting software monitors the transactions happening at your company and automatically categorises each item according to specified rules, filing the entry away into the correct account. The best part is that all of this happens in real-time, always keeping your accounts up to date.

Included in project costs

Thus, we have come up with the top five reasons accounting is important for a real estate business. All in all, avoiding mistakes like mixing personal and business accounts and not doing timely reviews should ensure that your accounts remain straight for the accountant to do the needful. It is an important practice to create categories for the itemisation of earnings and expenses.

- Here is a list of six important parameters to track in real estate accounting and reporting.

- Accounting in real estate agencies should track these expenses to better measure the returns these activities are generating.

- A cost accounting system and proper documentation are required to support cost capitalisation of internally incurred indirect costs.

- There are two key questions to ask yourself first in order to do the accounting properly for your real estate business.

- When organising the real estate accounting system at your firm, inculcate these best practices from the get-go to establish a process that is streamlined and efficient.

The real estate industry deals with a high volume of paperwork, and it is important to keep all of it organised for efficient, accurate accounting. When setting up accounting in real estate companies, it is important to keep these steps in mind to establish a system that is accurate and efficient. Good accounting practices include taking backups of important documents, processes, data, and information in case of unforeseen losses or mishaps. In the event of a surprise audit, all the necessary data needed would be in place and accessible, helping the auditor to wrap the process up quickly. When such a well-managed system is established in your real estate firm, the cash flows will begin to improve in the span of a few months. The table below highlights the important differences between real estate accounting and bookkeeping.

Expanded Credits and Deductions for Construction and Real Estate Industries

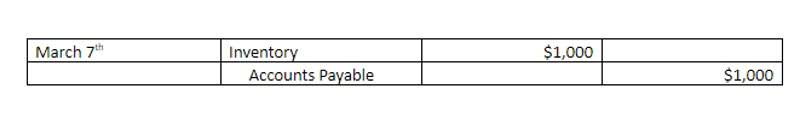

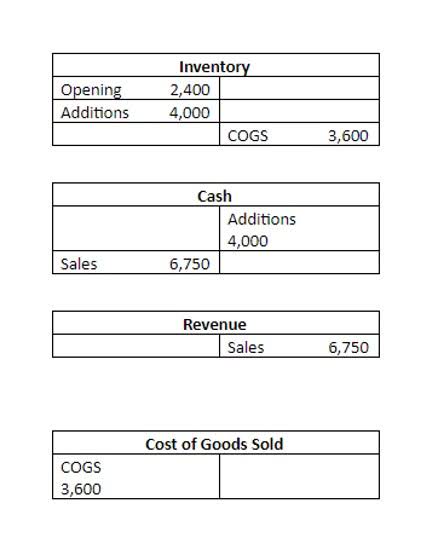

Indirect expenses, such as paying an administrative professional to run the office for their real estate development firm, are not included. When you’re developing real estate, you need to track the cost of goods sold (COGS), which is the total of several different expense accounts in your real estate accounting records. COGS refers to all direct expenses involved in developing your property, including paying electricians, hiring architects, obtaining permits, and buying building materials.

What is ASC 855?

ASC 855 describes the circumstances under which an entity should recognize events or transactions in its financial statements that occur subsequent to the balance sheet date but before the financial statements are available to be issued. This can have a potentially significant impact on loss contingencies.

Ultimately, you need to strike a balance that allows you to minimize both delays and cost increases while maintaining the quality of your project. The Accounts Receivables account should be an easy account to maintain. And, importantly, receivables should tie out to your monthly rent rolls paid at the beginning of each month. We invite you to experience finance and accounting outsourcing through us. Office supplies like pens, papers, inks, whiteboard markers, etc., typically go unaccounted for and may mount up to massive pending accounting.

How to do cost allocation?

Nearly all job costing software emphasizes the subcontractors or general contractor perspective where the detail drives the reporting. Our success in the developer market comes from its ability to go beyond the details and show management the top level project status. We want to tell you more about how Acumatica™ can significantly reduce time-consuming tasks for processing the accounting information https://www.bookstime.com/ for your real estate projects. Such concrete steps end up making a huge and positive impact on your business in the long run. Accounting remains an integral part of real estate, so; if you are looking forward to a successful real estate business, you have to take accounting seriously. Hiring an experienced offshore accounting agency offers you incredible benefits for your organization’s finances.

And real estate developers account for some of our largest clients.Preparing tax returns. Professional real estate accounting can assist you in developing effective business strategies. You can easily compare year-over-year growth and identify properties that are performing well or poorly. Accounting also provides you with performance data so that you can plan a capital raise. Every business aims towards minimum debts as debts can prove to be an ultimate threat to an organization. Hiring a real estate accountant can save a fortune every time you invest in a property.